The S&P 500 entered “corrective territory” for the first time in over 2 years as the Russian/Ukrainian conflict escalated.

First, I want to say that my commentary is apolitical. If it is factual, those facts are presented without a “political load.” Facts are facts unless proven otherwise.

Second, the market is unable to overcome the “wall of worry” which is being powered by 1) soaring inflation, 2) rising interest rates, 3) fear of a fed rate hike, 4) a White House where approval ratings are at all time lows, and 5) Russia/Ukraine.

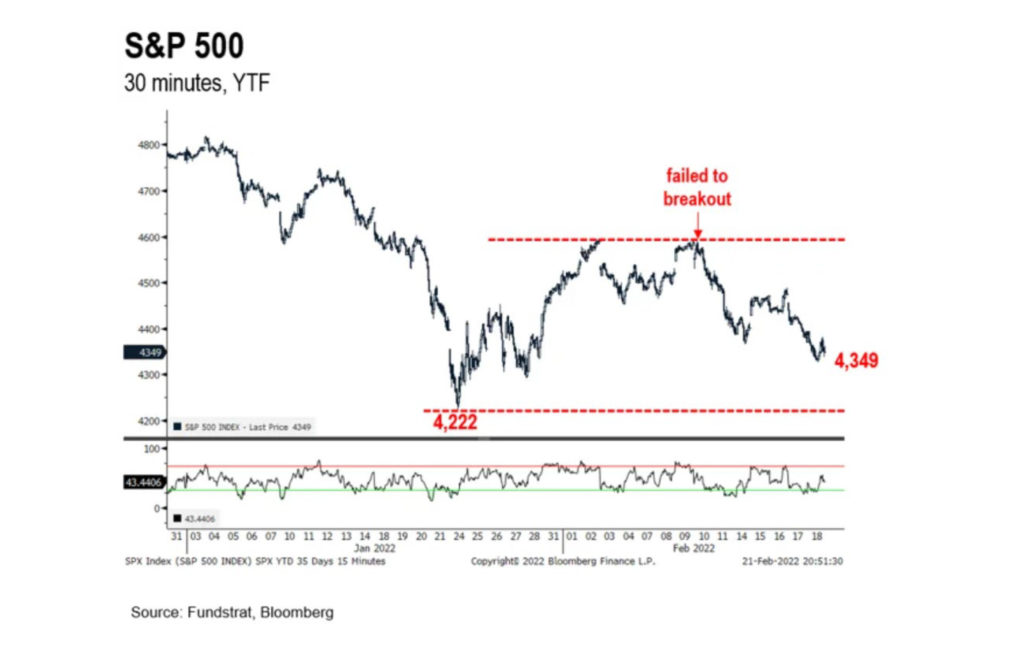

We had expected stocks to find some footing in February but, except for oil, stocks have had strong headwinds this month. From a technical perspective, stocks remain within a range that is “normal”, albeit, uncomfortable at the moment:

Turning first to Russia/Ukraine, if we look to history, the Russian invasion and conquering of Crimea under Obama’s watch was instructive: sell the buildup/ buy the invasion. If this “war” is similar, the market lows were close to being reached today and as the remainder of the

Turning first to Russia/Ukraine, if we look to history, the Russian invasion and conquering of Crimea under Obama’s watch was instructive: sell the buildup/ buy the invasion. If this “war” is similar, the market lows were close to being reached today and as the remainder of the

“invasion” unfolds, unless it turns out to be an all-out shooting conflict, the markets should rebound. It is important to remember that the size of the Russian economy is about as large as that of the State of Texas. The US economy eclipses the Russian economy, and the Russian economy is 70% dependent upon the sale of oil and gas. (So much for carbon credits…) What remains to be seen is how emboldened Putin and his government are. If they perceive of NATO as being unwilling to enforce borders, I think it is possible that aggression will build. If, however, they understand that financial and other sanctions may cripple their economy, then they will stop here…for a while.

One good aspect to the Russian/Ukrainian conflict is that the odds of March interest rate hikes has diminished in dramatic fashion.

In the U.S., Covid appears to be on the decline while vaccinations and boosters continue to inch higher. We find it interesting that seeming sacrosanct CDC guidance continues to shift on an almost daily basis and there are now reports that CDC intentionally withheld information which was contra to the vaccine mandates to boost consumer acceptance of vaccination and over fears that it might be misinterpreted. (NY Post, 2/22/22) Consumer spending has some upside to recovery, and this is good for economic growth which in turn supports stock prices.

Things we are watching over the coming days are:

1) Equity valuations – There are a lot of bargains, we believe.

2) Fed rate discussions – If the Fed gets more dovish, we think markets will rally, significantly.

3) Inflation numbers – At some point, high prices begin to create their own equilibrium through lost demand.

4) Russian capitulation – If their economy is 70% dependent upon the sale of fossil fuel products, it would seem logical that crippling their ability to sell product might dissuade them from further imperialistic forays.

5) White House – Unfortunately, in today’s “news cycle world,” politics does influence the economy.

Days like today are what we look for as bottoms and buying points. We think that we are close, despite the unknowns. There is, however, always the potential for a “black swan” event.

Best Regards,

Curt Lyman